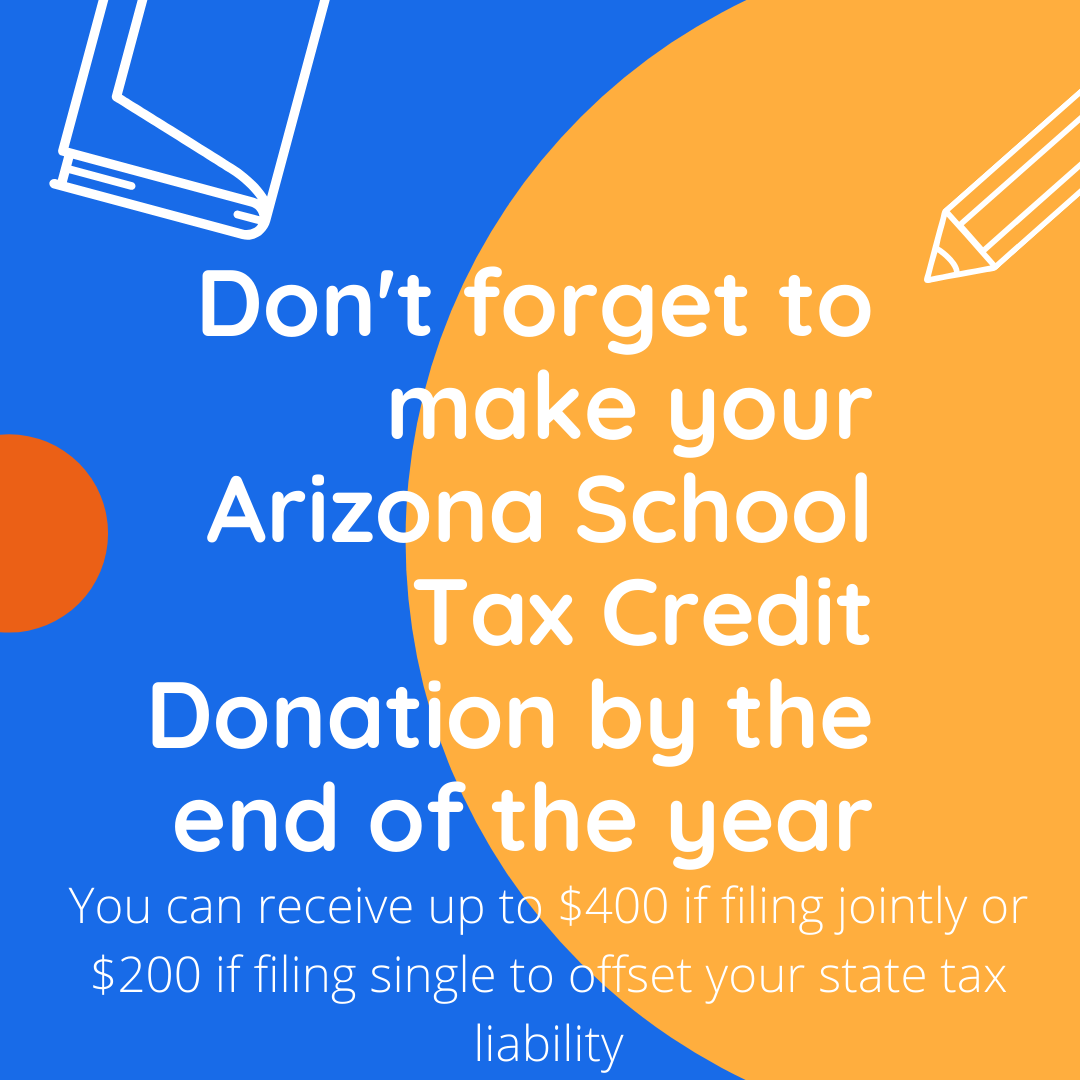

Individuals who make contributions or pay fees directly to a public school in this state for the support of eligible activities, programs, or purposes as defined by statute may claim a nonrefundable tax credit. Individual taxpayers claim the public school tax credit on Form 322. For married couples filing jointly, the maximum credit is $400; for single filers, heads of household, and married couples filing separately, the maximum credit is $200.

State Tax Credit Reminder